Smarter Investing For Income and Growth

Syndicate Multi-Family Real Estate

Many long-term wealth building opportunities exist in multi-family investments.

Why Real Estate

Investors who diversify into multi-family real estate outperform those who don't.

Direct multi-family real estate has outperformed the S&P by more than 60% since 2000. Using the "20% rule," where 20% of your portfolio is invested in alternatives like multi-family real estate helps earn greater returns and reduce volatility.

Why Multi-family

Long Performance History

As an evergreen investment in the basic need of shelter, multifamily apartments have been and always will be in demand.

Stable Asset Class

Since the Great Depression, commercial multifamily investments had 300% fewer down years compared to both the stock and bond markets.

Tax Advantages

Multifamily has a unique combination of four tax advantages not available to stock and bond investors.

Low Volatility

With low correlation to the stock market, multifamily investing offers enhanced stability and diversification from a traditional stock heavy portfolio.

Passive Ownership

With low correlation to the stock market, multifamily investing offers enhanced stability and diversification from a traditional stock heavy portfolio.

Lower Risk Than Stocks

With the best Sharpe ratio over the last 20 years, real estate investing provides compelling risk-adjusted returns compared to other asset classes.

The Demographic Wave

-

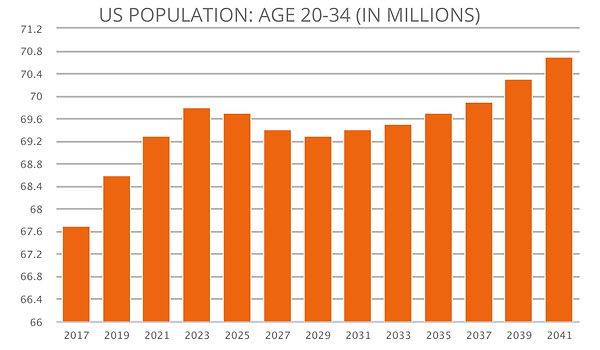

The 20-34 age group is the single largest age group that rents.

-

There are over 67.5 million people aged 20-34 in U.S.

-

Currently, 60-70% of those people rent.

-

The number is expected to grow over the next 30 years.

Multi-family investments are controlled by 30 to 40 year-long demographic cycles, not 7 to 8 year economic cycles.

The Upside Difference

We provide investors access to a professionally managed, diversified portfolio of income-producing multi-family real estate, once only available to professional and high net-worth (accredited) investors. As a time-tested investment firm with a proven track record in both up-and-down cycles, we focus on investing for immediate income in areas with strong economics for long-term upside accumulation.

Market Location

We invest in apartments, senior living, single family subdivisions, and student housing across the U.S. Not being limited to a geographical area means that we can cherry-pick from the best assets, in the most desirable markets, with the best fundamentals.

Growth and Income

Our portfolio of stabilized and value added real assets are selected for maximum yield. We focus on generating ongoing cash flow, as well as, long-term appreciation.

Experience

The team being Syndicate Multi-Family Real Estate has been at this for a while. We've seen both up-and-down markets. We've been through recessions and real estate bubbles, and we know how to capture the upside.